Revocation of Power of Attorney – Cancels an existing power of attorney.

#Does power of attorney need to be notarized in illinois registration#

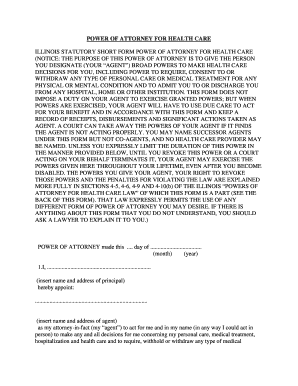

Vehicle (DMV) Power of Attorney – Can be executed to grant a representative to handle the sale, purchase, or registration of a motor vehicle for the principal. Required by most tax accountants and lawyers when filing on their client’s behalf. Tax Power of Attorney (2848) – For Federal (IRS) or state tax purposes. Real Estate Power of Attorney – Permits a representative to make buying, selling, and leasing decisions on the principal’s behalf. This instrument is effective only for a short period, typically a maximum of 6 to 12 months, but this varies state by state. Minor (child) Power of Attorney – Allows a parent or guardian to allow someone else to make decisions on behalf of their child. Medical Power of Attorney – Gives an agent the right to act on a person’s behalf for medical decisions (only if the principal can no longer make decisions themselves). Usually coupled with medical power of attorney. Living Will – Sets end-of-life treatment options for a patient. This document becomes void after the agent has fulfilled their duty.

Limited Power of Attorney – Allows an agent to act on behalf of the principal for a specific purpose. General Power of Attorney – Permits an agent to take someone’s place for financial decisions, but becomes invalid if the principal becomes incapacitated.

Can be used to give a person authority for general life tasks (such as cashing a check).ĭownload: PDF, Word (.docx), OpenDocumentĪdvance Directive – Combines a living will and medical power of attorney into one (1) document.ĭurable Power of Attorney – Allows an agent to take someone’s place for financial decisions and remains valid if the principal should become incapacitated. Simple (1 page) Power of Attorney – A simplified variation of the limited power of attorney form. Can be used for finances, medical matters, taxes, real estate, and more.Durable: does not terminate if the principal is incapacitated.Allows a person to act on behalf of another person.

0 kommentar(er)

0 kommentar(er)